The MFO 2023 Consumer Economic Sentiment report is the latest in a series of studies that plumb Trinidad and Tobago’s sentiment levels. MFO first ran studies in the 2002 – 2011 period. It resumed in 2016.

These new results highlight a return to pre-pandemic 2017 sentiment levels. Our respondents are more optimistic than they were for the last five years.

- Market Facts & Opinions (2000) Ltd

- mfo@mfocaribbean.com

- Tel: (868) 627-8417/8524

Things Are a-Changing

“We made it!”

The official multilateral institutions’ reports corroborate this ‘feeling-good’ sentiment. The economy has weathered the COVID-19 storm. Trinidadians are hopeful about the short-term future but are still moderately cautious about their spending. This sense of vulnerability is expected in a world as volatile as ours.

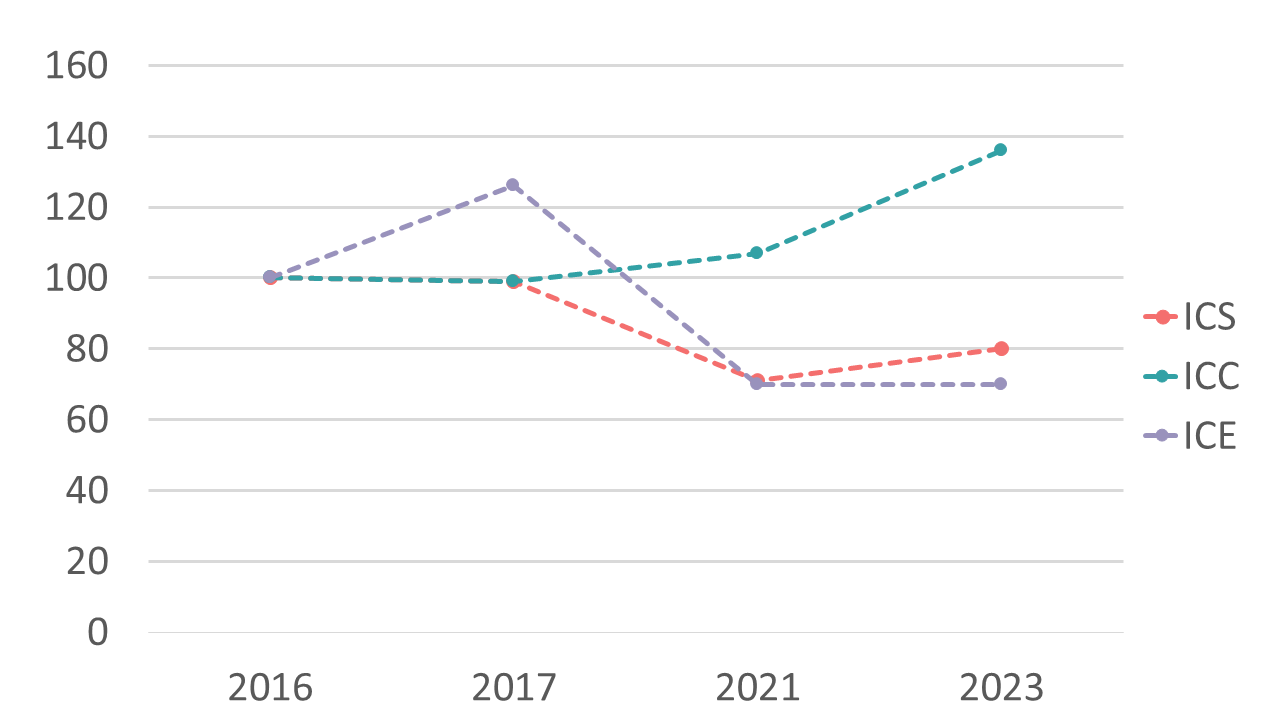

Indices 2016-2023

Subsets of ICS

ICS: Index of Consumer Confidence/Sentiment – assesses current personal finances over the last year and expected personal finances for the next year; expected business conditions over the next year; medium-term national economic outlook and current buying conditions.

ICC: Index of Current Consumption – assesses current personal finances over the last year and current buying conditions

ICE: Index of Consumer Expectations – assesses expected personal finances for the next year; expected business conditions over the next year; medium-term national economic outlook

“How will we go forward?”

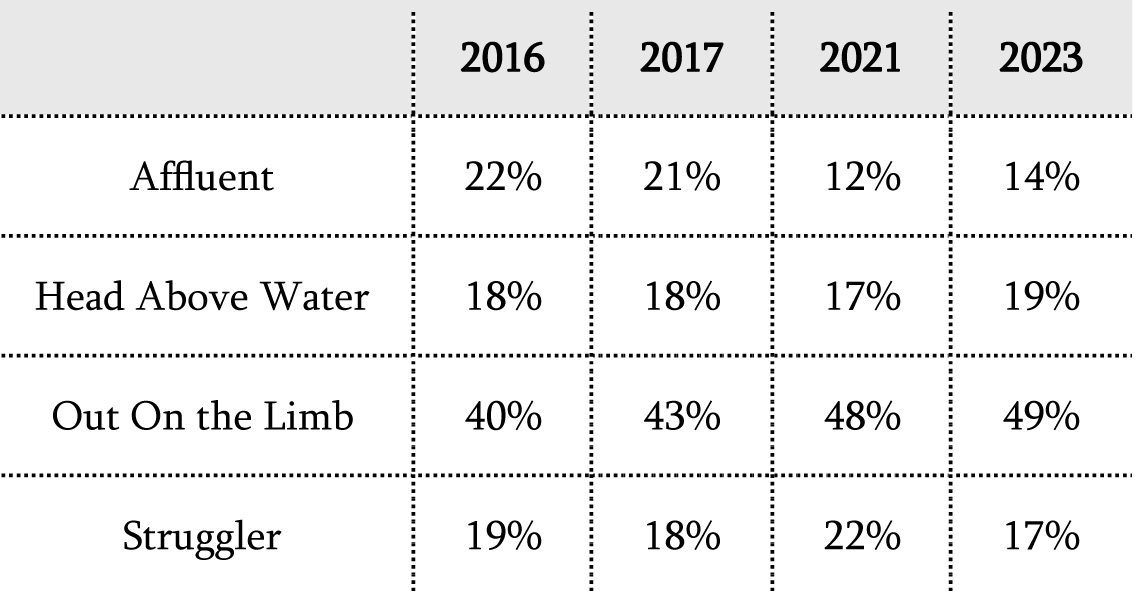

It is helpful to track the self-perception of our respondents over the years. The group labelled “Affluent” has not recovered to its 2016 size, even while the “Struggler” group has returned to its original size. Notably, the “Out on the Limb” group has held constant since 2021 and represents half the total population.

Family Financial Situation⁺

⁺These attributes are subjectively based on respondents’ perception.

Definition of Terms Used:

Affluent- Living comfortably

Head Above Water- Meeting basic expenses with some extra money

Out On the Limb- Meeting basic expenses

Struggler- Not meeting basic expenses

This self-perception will collide with the inflationary impulse in the country. A super-majority of the population (86%) expects prices to continue to rise even while their incomes are unlikely to grow at the same rate. What will the market do?

From newspaper reports, the retailers and local manufacturers appear to be adopting what is described as a “Rockets and feathers” strategy. It is called this because when companies’ input costs go up, for some reason, the prices they charge their customers go up like a rocket. But when their input costs go back down, their prices fall, but ever so slowly, like a feather. In short, charge what the market can bear. The expectation is that consumers will have become accustomed to the higher prices, so there will be no need to reduce them.

Is that a great strategy? It depends. Who is your market? What are they likely to do?

Which of these segments form the core of your market? Bear in mind that the response from each sector will differ. If the consumer is worried about future price increases and is stressed by trying to survive without a safety net, what will be your offering and message?

“What does this mean for brands?”

While the percentage of individuals purchasing the same brands they are accustomed to has remained relatively stable at 54% (2023) compared to 56% (2021) in the previous study, there has been an increase in the proportion of people (51%) who are now using brands they would not typically buy (39% in 2021). Consumers are experimenting with previously unused brands as they seek value at a lower cost. This trend suggests that consumers are displaying a level of flexibility and adaptation in their purchasing decisions.

Brands can no longer rely on being transactional in their dealings with consumers.

Of particular concern is our 18-24 age cohort, who are more likely to report challenges in meeting their basic expenses compared to older individuals. Older consumers indicate that they continue to purchase their usual brands, while the younger age group being more financially constrained, tends to explore more affordable options or alternative brands.

The report also highlights the changes in the “customer journey” or the entire customer experience with your brand. The journey has changed since the Covid-19 experience: it has become more digitized, and the nature of shopping trips has changed.

“What are the big challenges?”

What should be the pricing strategy that would maintain profit and volume levels? Are brands prepared to allow new consumers to experiment with new or lesser-known brands?

How do brands engage and build a relationship with the different customer segments? A differentiated communication strategy must be developed.

Companies must also prioritize and strengthen their omnichannel capabilities, ensuring their digital and brick-and-mortar shopping experiences are aligned and seamless, providing satisfactory service across every touchpoint.

Creating a winning ‘go-to-market’ strategy requires deeper consumer insights. MFO is prepared to help you with that task. We know the consumer, and can help you tailor your offerings for better results.

See the below details for more information or to purchase the MFO 2023 CES Resources:

Contact Information:

Ms. Alexcia Nelson

Administrative Assistant

Email: mfo@mfocaribbean.com

Tel: (868) 627 – 8417/8524

Available resources:

- Detailed Final Report with Key Recommendations $5000 + VAT

- Tailored Executive Presentation focused on Client’s Industry $4000 + VAT

- Package Deal: Report + Presentation $7200 +VAT (20% Discount)