- Market Facts & Opinions (2000) Ltd

- mfo@mfocaribbean.com

- Tel: (868) 627-8417/8524

T&T debt is now significant, how did this happen?

T&T debt is the money owed by Government. Now our debt is now a significant risk. How did this happen? Who benefitted?

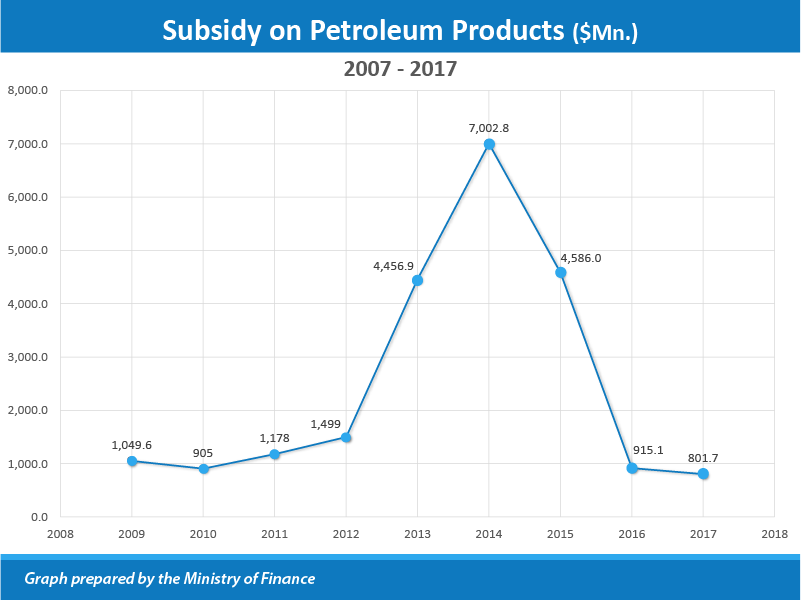

Note the sharp increase in the gas subsidies between 2012 and 2016. Three times the amount spent in 2012 was spent in 2013 and in the next year (2014) that new base jumped by 1.57 times. It then declined back the 2013 number in 2015. How could there be so much variation between years if it were only poor people travelling in their small cars? What caused the spike and then the fall?

The IMF reported that in 2014 that the bottom 50% of our population got 27% of the benefit compared to 36% for the top 15% of households.

Who really loses with the removal of the subsidies? Why are we talking about the poor people when we talk about the removal of this subsidy? Should we not be talking about a better way of transportation for the poor people?

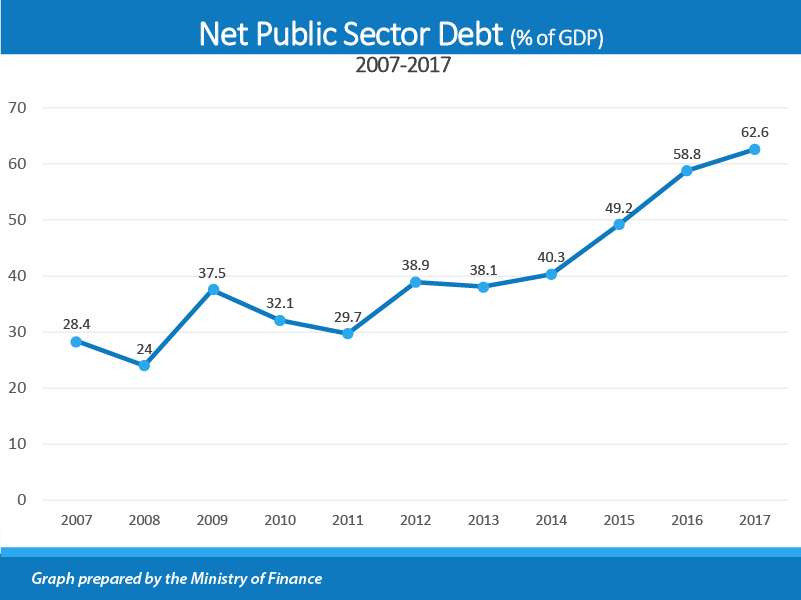

Public Sector Debt is the money owed by Government, be it to local or foreign lenders or the guarantees they give to back loans for State Enterprises and Statutory Authorities. It is normally expressed as a % of the amount of money that the country makes (GDP).

Note how that percentage increases from 2011 to the present. This has happened because of the situation described in the earlier posts re expenses and the drop in income. Two things were happening at the same time: the expenses were rising and our income was dropping.

The curve of the debt is more important than the absolute number; our curve is steadily rising. When debt is high relative to your income you have to reduce your debt or increase your income. The alternative is that the bankers will come looking for you. If your mortgage payments, as a proportion of your income, increases because your salary has dropped then the bank is going to be nervous about getting back their money. What can you do to keep them off?

That is the same problem we face as a country. Our debt is now at a level where it is considered to be a significant risk. When this happens, our interest payments become a greater part of our expenses and we run the risk of the bankers increasing the rate at which they charge us interest.

What can we do? Can we get our income back up in the short term? How? Can we cut our expenses? Where? Can we ask each to reduce their share of the income? Who and how do we do that?